Who We Are

We Develop Quality Infrastucture And Real Estate Projects Since 2001

22 +

YEARS OF

ESTABLISHMENT

12 +

mn sq. ft.

UPCOMING

DEVELOPMENT

Our Vision & Core Values

Our Vision

Our vision is to dilate our horizon and be recognized as a respected diversified conglomerate, a name which is synonymous to brand representing 'Trust'.

Our Mission

To provide customer satisfaction and create value for stakeholders through professionalism, transparency, quality, cutting-edge technology and social responsibility.

Core Values

Trust: We maintain 100% transparency in our work and guide our clients towards valuable deals.

Self-Discipline: Our 'just do it' attitude always keeps us on our toes.

Courage: We constantly try to keep up with challenging projects and work upon them.

Explore Our Projects

Bringing Communities Closer Together

Explore Our Projects

Bringing Communities Closer Together

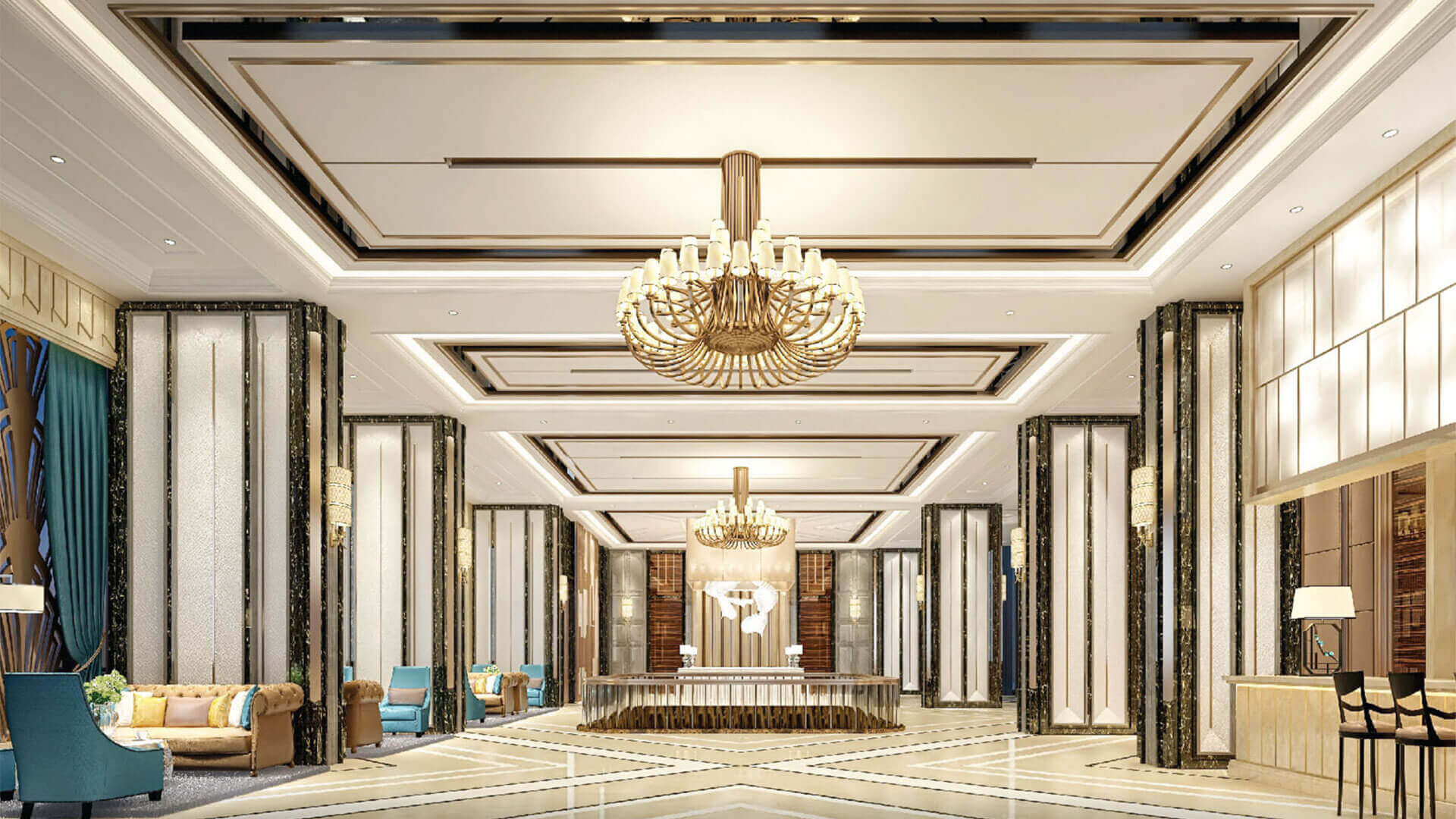

VKG Centurion

Goregaon (E)

Igatpuri Township

nashik

VKG Park Estate

Mumbai

Marol VKG Estate Phase II

Mumbai

BKC Kapadia Nagar

Mumbai

Ghatkopar East

Mumbai

Ulhasnagar Township

Ulhasnagar

Igatpuri Township

Nashik

Marol VKG Estate Phase II

Mumbai

BKC Kapadia Nagar

Mumbai

Ghatkopar East

Mumbai

Ulhasnagar

Ulhasnagar

Kandivali East

Mumbai

Worli

Mumbai

Joy Apartment CHS

Andheri East - Residential

Year 1974

Kondivita CHS

Andheri East - Residential

Year 1976

Ankur CHS

Andheri East - Residential

Year 1982

Mukund Nagar CHS

Andheri East - Residential

Year 1984

Marol Co-operate Industrial Estate

Andheri East - Residential

Year 1988

UjwalNand Deep CHS

Malad West - Residential

Year 1987

Tirumala & Tirupati CHS

Andheri East - Residential

Year 1994

Industrial factory at Solapur

MIDC Solapur - Commercial

Year 1996

AVKG Corporate Centre (A) & (B)

Andheri East - Commercial

(Year 2006)

VKG Corporate Point

Andheri East - Commercial

(Year 2008)

VKG Corporate Pride

Andheri East - Commercial

(Year 2015)

Joy Apartment CHS

Andheri East - Residential

Year 1974

Kondivita CHS

Andheri East - Residential

Year 1976

Ankur CHS

Andheri East - Residential

Year 1982

Mukund Nagar CHS

Andheri East - Residential

Year 1984

Marol Co-operate Industrial Estate

Andheri East - Residential

Year 1988

UjwalNand Deep CHS

Malad West - Residential

Year 1987

Tirumala & Tirupati CHS

Andheri East - Residential

Year 1994

Industrial factory at Solapur

MIDC Solapur - Commercial

Year 1996

AVKG Corporate Centre (A) & (B)

Andheri East - Commercial

(Year 2006)

VKG Corporate Point

Andheri East - Commercial

(Year 2008)

VKG Corporate Centre (A) & (B)

Chakala - Residencial

VKG Krishna Residences

Chakala - Residencial

Industrial factory at Solapur

MIDC Solapur - Commercial

Year 1996

Our Happy Customers

What Our Customers Say About Us

It has been a wonderful experience dealing with team Om Sree. Being a service personnel my outlook was to look for convenient, peaceful and a happy environment (preferably closer to flock of ex-servicemen oriented facilities). This was well catered to the options with Green Front offered.

Efecha Omoware

Member of Genome Valley CompaniesIt has been a wonderful experience dealing with team Om Sree. Being a service personnel my outlook was to look for convenient, peaceful and a happy environment (preferably closer to flock of ex-servicemen oriented facilities). This was well catered to the options with Green Front offered.

Efecha Omoware

Member of Genome Valley CompaniesIt has been a wonderful experience dealing with team Om Sree. Being a service personnel my outlook was to look for convenient, peaceful and a happy environment (preferably closer to flock of ex-servicemen oriented facilities). This was well catered to the options with Green Front offered.

Efecha Omoware

Member of Genome Valley CompaniesIt has been a wonderful experience dealing with team Om Sree. Being a service personnel my outlook was to look for convenient, peaceful and a happy environment (preferably closer to flock of ex-servicemen oriented facilities). This was well catered to the options with Green Front offered.